- Expert advice/

- Relationship advice/

- Newlywed couples

- Relationship advice

Newlywed couples

Congrats Newlyweds! As your wedding celebrations come to an end, you might be asking yourselves some questions on topics like combining finances, navigating post-wedding blues (it's a thing!) or buying a house and preparing to start a family. Find expert marriage advice to guide you through the start of your forever and beyond.

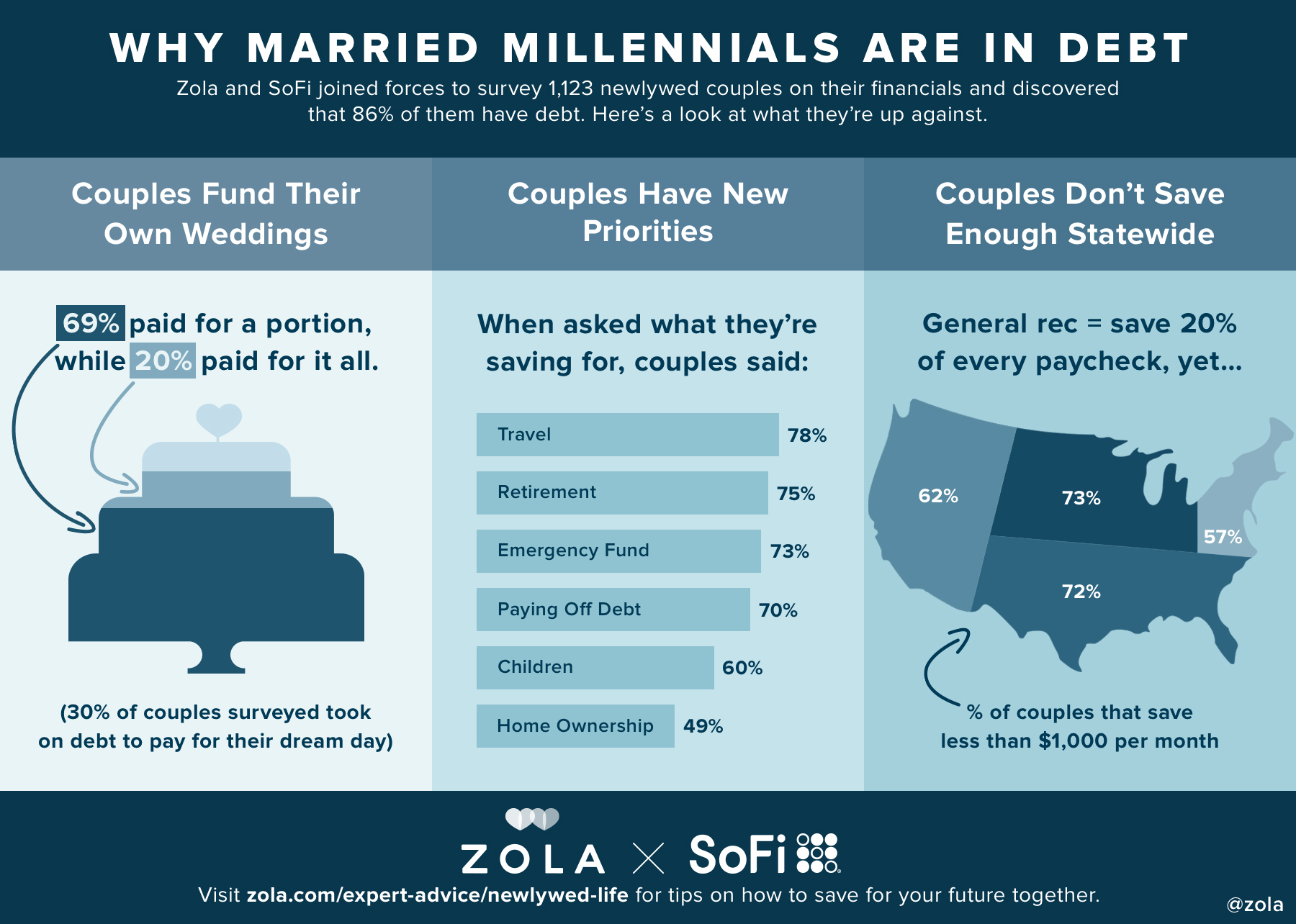

Why Married Millennial Couples Are In Debt

We know that the planning doesn’t stop after the wedding. When it comes to combining finances before and after marriage, there’s so much to navigate — from budget talk and combining bank accounts to paying debt, creating financial savings goals, credit, and beyond.

5 Finance Topics Newlyweds Need to Discuss Post-Wedding

Finances aren't always the most fun to talk about—but they are necessary, especially for newlyweds. Find out what newlywed finance talks to focus on and how to make the money talk feel easier.

3 Tax Changes Newlyweds Need to Make

Now that your married, your taxes will change. Get started and keep it simple with our top three tax tips for newlyweds.

Who Needs Renters Insurance?

If you pay rent, you need renters insurance. If you have a property, you can't afford to replace, you need renters insurance.

How To Buy Family Life Insurance

There are several ways to protect your whole family with life insurance, and we can walk you through your options.

Here's How To Build Your Best-Ever Newlywed Budget

From small expenses to big-picture financial decisions, here's how you and your new spouse can build your best budget together.

How Spouses Can Shop For Life Insurance

Save time and hassle by shopping for policies together to protect your family’s future.

Is A Joint Life Insurance Policy Right For You?

Couples can either purchase separate life insurance policies, or they can buy joint life insurance, which is one policy that covers two people. It’s an option that not many people know about, and depending on your situation, it might be the right answer for you.

Your Guide to The Different Types of Homeowners Insurance

Homeowners insurance is for your house, apartment, condo, mobile home, and more. Here's everything you need to know.

How to Make a Personalized Wedding Photo Album

Do you want to create a wedding album yourself? We've got you covered! Continue reading to learn how to make your own wedding album online.

- Expert advice/

- Relationship advice/

- Newlywed couples

Find even more wedding ideas, inspo, tips, and tricks

We’ve got wedding planning advice on everything from save the dates to wedding cakes.